Cheyenne Federal Credit Union: Phenomenal Financial Providers for You

Cheyenne Federal Credit Union: Phenomenal Financial Providers for You

Blog Article

Federal Credit Rating Unions: Your Entrance to Financial Success

By supplying customized economic services and academic sources, Federal Credit rating Unions lead the way for their members to reach their monetary objectives. Sign up with the discussion to uncover the key advantages that make Federal Credit score Unions the entrance to financial success.

Benefits of Joining a Federal Lending Institution

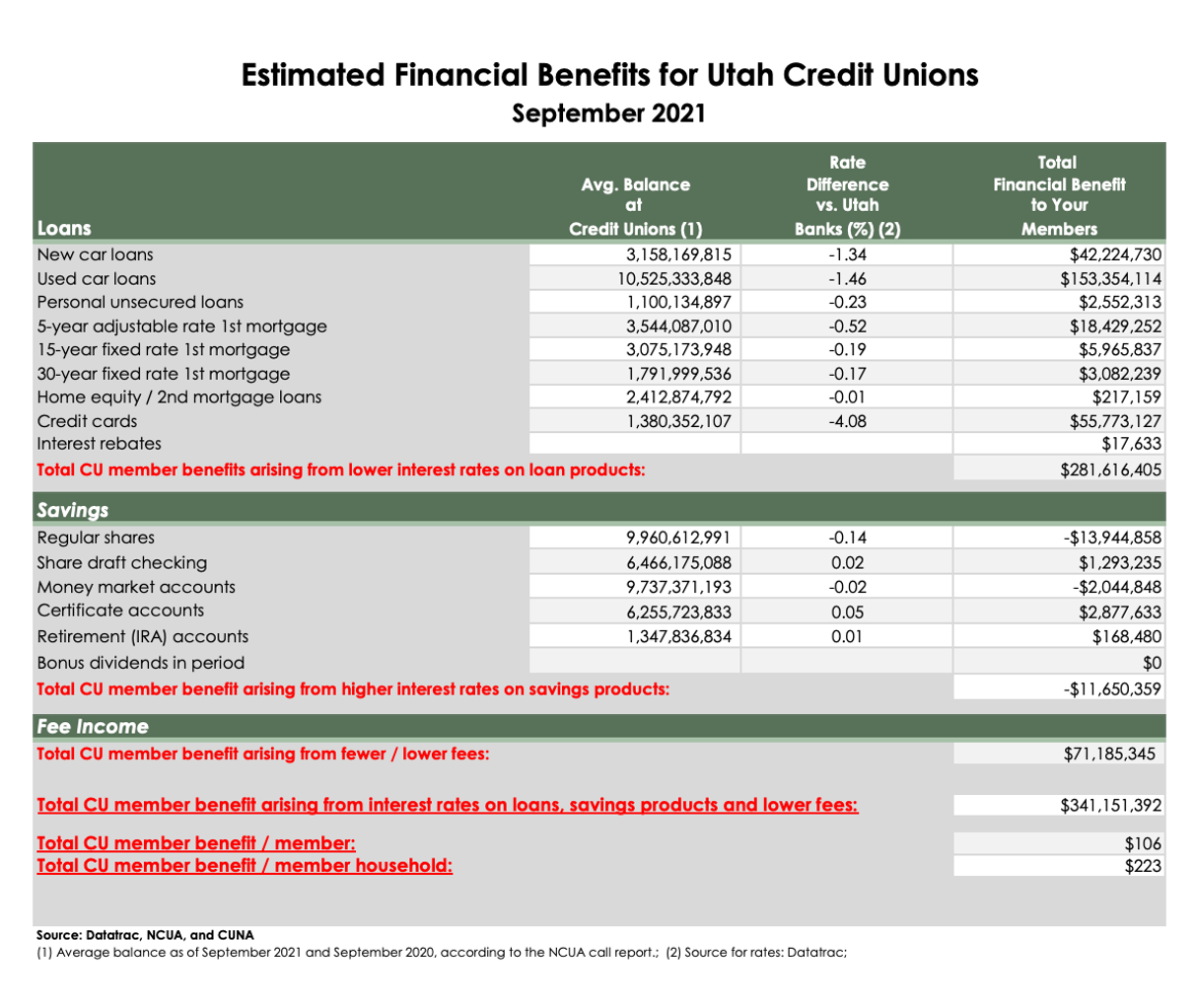

Joining a Federal Lending institution offers many advantages that can dramatically boost your financial well-being. One of the essential advantages is generally lower fees compared to conventional financial institutions. Federal Cooperative credit union are not-for-profit companies, so they usually have lower overhead expenses, enabling them to pass on these cost savings to their members in the form of reduced fees for services such as checking accounts, lendings, and charge card. Furthermore, Federal Cooperative credit union normally use greater rate of interest rates on interest-bearing accounts and certifications of down payment (CDs) than standard financial institutions, offering members with the opportunity to grow their financial savings faster.

An additional advantage of signing up with a Federal Credit scores Union is the personalized solution that members get - Credit Unions Cheyenne WY. Unlike large banks, Federal Cooperative credit union are understood for their community-oriented technique, where members are treated as valued people rather than simply an account number. This personalized service usually translates into more customized financial remedies and a far better general financial experience for participants

Series Of Financial Solutions Supplied

Federal Debt Unions provide a detailed variety of economic solutions developed to provide to the varied needs of their members. These establishments focus on monetary education by supplying workshops, seminars, and online sources to encourage participants with the understanding needed to make educated monetary choices. By supplying this wide array of services, Federal Credit Unions play an important role in sustaining their members' financial wellness.

Affordable Prices and Personalized Solution

In the world of economic services supplied by Federal Credit score Unions, one standout facet is their commitment to offering competitive rates and customized solution to make certain participants' satisfaction. Federal Credit score Unions aim to supply their participants with rates that are usually extra favorable than those offered by traditional financial institutions. These affordable rates expand to numerous economic items, including interest-bearing accounts, loans, and bank card. By providing affordable prices, Federal Cooperative credit union aid their members save money on rate of interest repayments and earn more on their down payments.

Exclusive Advantages for Members

Participants of Federal Lending institution access to a variety of unique advantages developed to boost their monetary wellness and total financial experience. These benefits consist of lower loan rate of interest prices compared to typical banks, higher interest rates on savings accounts, and less charges for services such as over-limits or ATM use. Federal Cooperative credit union participants likewise have actually access to individualized economic suggestions and assistance in creating budget plans or taking care of financial debt. Moreover, members can join financial education programs and workshops to enhance their money administration abilities.

Furthermore, Federal Cooperative credit union usually provide advantages such as reduced rates on insurance coverage products, credit surveillance services, and identification burglary security. Some cooperative credit union even provide special participant price cuts on neighborhood occasions, tourist attractions, or solutions. By becoming a participant of a Federal Lending institution, people can appreciate these unique advantages that are tailored to aid them save cash, develop wealth, and accomplish their financial goals.

Getting Financial Goals With Federal Debt Unions

Credit report unions offer as indispensable companions in assisting individuals accomplish their economic goals with customized economic solutions and personalized advice. One key element of attaining financial goals with government credit scores unions is the emphasis on member education and learning.

Furthermore, government credit history unions supply a vast array of solutions and items developed to support members in reaching their monetary turning points. From competitive savings accounts and low-interest fundings to retirement planning and investment opportunities, credit history unions use comprehensive remedies to resolve varied economic demands. By leveraging these offerings, participants can develop a strong monetary structure and job in the direction of their long-lasting goals.

Additionally, government lending institution typically have a community-oriented approach, cultivating a sense of belonging and assistance amongst members. This public element can better motivate individuals to stay committed to their financial goals and commemorate their accomplishments with similar peers. Inevitably, partnering with a federal credit report union can significantly enhance a person's journey in the direction of economic success.

Verdict

In verdict, government cooperative credit union provide a series of economic solutions and benefits that can aid individuals achieve their economic goals. With affordable prices, personalized solution, and unique participant benefits, these not-for-profit Web Site organizations serve as an entrance to monetary success. By focusing on participant education and community involvement, government credit unions equip people on their trip towards economic security and success.

By offering customized instructional sources and monetary services, Federal Credit Unions pave the method for their participants to reach their economic goals. These institutions focus on monetary education and learning by offering workshops, workshops, and online resources to empower members with the knowledge needed to make enlightened economic decisions. Whether it's applying for a funding, setting up a savings plan, or looking for economic recommendations, members can expect customized solution that prioritizes their monetary well-being.

Report this page